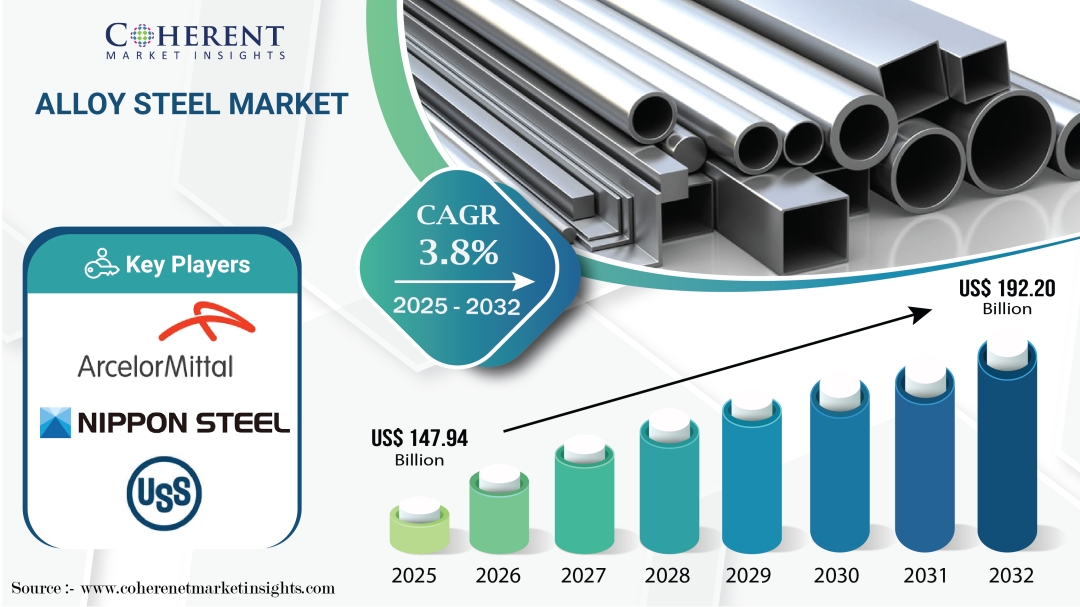

Alloy Steel Market Size to Hit USD 192.20 Billion by 2032 | 3.8% CAGR Fueled by Infrastructure and Energy Sectors

The Global Alloy Steel Market size is estimated to be valued at USD 147.94 Bn in 2025 and is expected to reach USD 192.20 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 3.8% from 2025 to 2032. This market report underscores robust market growth fueled by technological upgrades, strategic capacity expansions, and evolving end-use applications. Recent market revenue data for 2024 indicated a 4% year-on-year increase, validating our forecast and providing granular market analysis for stakeholders. Furthermore, share consolidation among the top five alloy steel producers reached approximately 60% in 2024, highlighting competitive intensity. Regionally, Asia Pacific dominated with over 45% of global consumption, while Europe and North America continue to invest in low-carbon technologies. The market scope now includes advanced high-strength grades for EV manufacturing, reflecting evolving performance specifications. Such dynamics accentuate the need for continuous market analysis and agile business growth strategies.

Request Sample Copy of this Report (Use Corporate eMail ID to Get Higher Priority) at : https://www.coherentmarketinsights.com/insight/request-sample/7619

Key Takeaways:

Region:

– North America: Robust automotive and aerospace alloy steel demand, driven by US EV production.

– Latin America: Pipeline and construction projects in Brazil and Argentina boosting grade usage.

– Europe: Emission norms fostering low-carbon alloy steel adoption in Germany and France.

– Asia Pacific: Industrial expansions in China and India elevating mill capacity.

– Middle East: Oil & gas infrastructure projects in GCC nations increasing corrosion-resistant steel usage.

– Africa: Mining and heavy equipment demand in South Africa and Egypt rising alloy steel consumption.

Market Segment :

By Grade: Low-alloy (e.g., 4140 for gears); high-alloy (e.g., 904L in chemical plants).

By Application: Automotive (powertrain components); oil & gas (offshore pipelines).

By Form: Bars & rods (construction rebar); plates (shipbuilding hulls).

market Growth Factors:

– EV acceleration: Global EV output reached 11.5 M units in 2024, boosting high-strength, lightweight alloy steel demand by 6%.

– Renewable energy build-out: Offshore wind capacity grew 10% in 2025, driving 5% uptick in corrosion-resistant grades.

– Infrastructure spending: USD 20 Bn in bridge and tunnel projects across Asia Pacific spurred a 4.5% alloy steel demand increase in 2024.

– Scrap supply constraints: Europe’s scrap availability fell 3% in 2024, impacting production costs and shaping growth factors.

– Steel decarbonization: Investment in electric arc furnaces rose 8% in 2024, aligning with low-carbon growth strategies.

Purchase Now Up to 25% Discount on This Premium Report @ https://www.coherentmarketinsights.com/insight/buy-now/7619

Market Trends:

– Digital forging: IoT-enabled lines increased throughput by 8% in 2024, marking a key Alloy Steel Market trends shift toward Industry 4.0.

– Low-carbon steel: Nippon Steel’s e-furnace project cut CO₂ emissions by 18% in 2024, accelerating sustainable alloy development.

– Advanced alloys: Maraging steel for aerospace achieved 10% weight reduction in early 2025, indicating trend evolution.

– AI integration: Predictive maintenance models reduced downtime by 12% in European mills in 2024.

– Reshoring initiatives: Five new North American steel plants announced in 2025, reversing offshoring trends.

Actionable Insights:

– Production capacity: Global alloy steel capacity reached 140 Mt in 2024; scheduled additions of 12 Mt by 2026.

– Pricing: Average alloy steel price hit USD 1,150/t in Q4 2024.

– Export volumes: China’s exports topped 35 Mt in 2024; Southeast Asia imports grew by 7%.

– EU imports: 8 Mt of high-alloy grades in 2024; micro-indicator scrap supply fell 3%.

– Use-case index: Automotive accounted for 28% of total consumption; pipeline at 22%.

– Alloy Steel Market revenue rose 5% YoY in 2024, driven by premium-grade sales.

Key Players:

• ArcelorMittal

• Tata Steel Limited

• Nippon Steel Corporation

• China Baowu Steel Group

• POSCO

• JFE Steel Corporation

• United States Steel Corporation

• Nucor Corporation

• Thyssenkrupp AG

• Steel Dynamics, Inc.

• SSAB AB

• JSW Steel Limited

• Gerdau S.A.

• Essar Steel

• Steel Authority of India Limited (SAIL)

• Voestalpine AG

• Evraz plc

• NLMK Group

• Baosteel Group

• Severstal

Competitive Strategies:

ArcelorMittal’s low-carbon TechSteel line, launched in 2024, secured contracts worth USD 1.2 Bn and enhanced Alloy Steel Market share in Europe. Tata Steel’s joint venture in the UK expanded capacity by 2 Mt in 2025, yielding a 6% production boost. Nippon Steel’s collaboration with Toyota on automotive-grade alloys cut processing times by 15% in Q1 2025, strengthening its competitive positioning.

Get Customization on this Report: https://www.coherentmarketinsights.com/insight/request-customization/7619

FAQs:

1. Who are the dominant players in the Alloy Steel Market?

Leading producers include ArcelorMittal, Tata Steel Limited, Nippon Steel Corporation, China Baowu Steel Group, POSCO, and JFE Steel Corporation, together representing over 60% of industry share.

2. What will be the size of the Alloy Steel Market in the coming years?

Our market forecast projects the Alloy Steel Market size to grow from USD 147.94 Bn in 2025 to USD 192.20 Bn by 2032 at a CAGR of 3.8%.

3. Which end-user industry has the largest growth opportunity?

The automotive segment, driven by EV and lightweight component demand, accounts for nearly 28% of total Alloy Steel Market revenue and offers the highest expansion potential.

4. How will market development trends evolve over the next five years?

Key Alloy Steel Market trends include digital forging adoption, low-carbon steel initiatives, advanced alloy development, AI integration, and regional reshoring efforts.

5. What is the nature of the competitive landscape and challenges in the Alloy Steel Market?

Competition centers on capacity expansions, sustainability-driven product launches, strategic JVs, and digital upgrades. Challenges include raw material volatility and stringent regulatory requirements.

6. What go-to-market strategies are commonly adopted in the Alloy Steel Market?

Companies deploy capacity partnerships, low-carbon product lines, technology collaborations (e.g., Nippon Steel and Toyota), and targeted geographic expansions to drive business growth.

✍️ Author of this marketing PR:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc.

About Us:

Coherent Market Insights leads into data and analytics, audience measurement, consumer behaviors, and market trend analysis. From shorter dispatch to in-depth insights, CMI has exceled in offering research, analytics, and consumer-focused shifts for nearly a decade. With cutting-edge syndicated tools and custom-made research services, we empower businesses to move in the direction of growth. We are multifunctional in our work scope and have 450+ seasoned consultants, analysts, and researchers across 26+ industries spread out in 32+ countries.

Media Contact

Company Name: Coherent Market Insights

Contact Person: Mr. Shah

Email: Send Email

Phone: + 12524771362

Address:533 Airport Boulevard, Suite 400, Burlingame, CA 94010, United States

City: Burlingame

State: california

Country: United States

Website: https://www.coherentmarketinsights.com/industry-reports/alloy-steel-market