Toronto’s Condo Market Enters a Strategic Reset: Experts Say It’s Time to Rethink the Narrative

Toronto’s condominium market is undergoing a dramatic but overdue recalibration, and experts say the shift is less a crisis and more an opportunity. With prices softening, inventory swelling, and investor sentiment cooling, a new chapter is opening in Toronto real estate—and it’s one buyers may not want to miss.

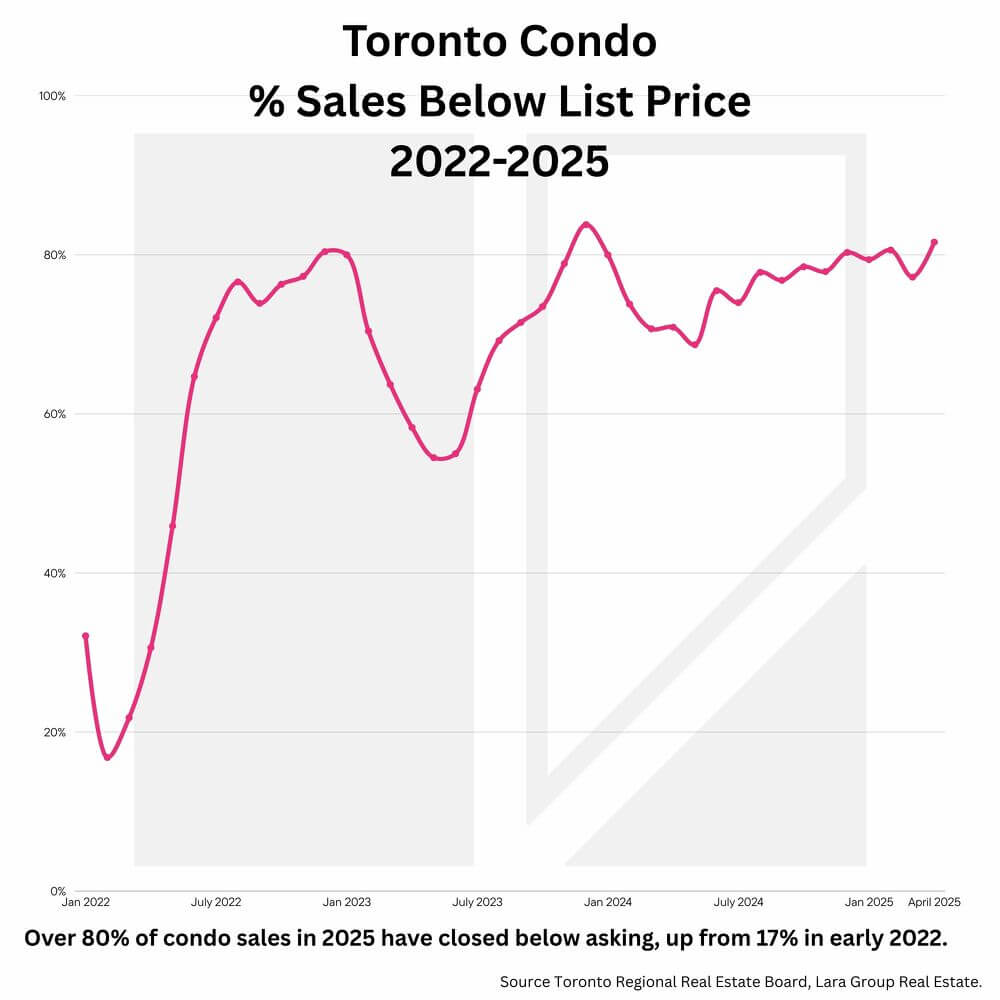

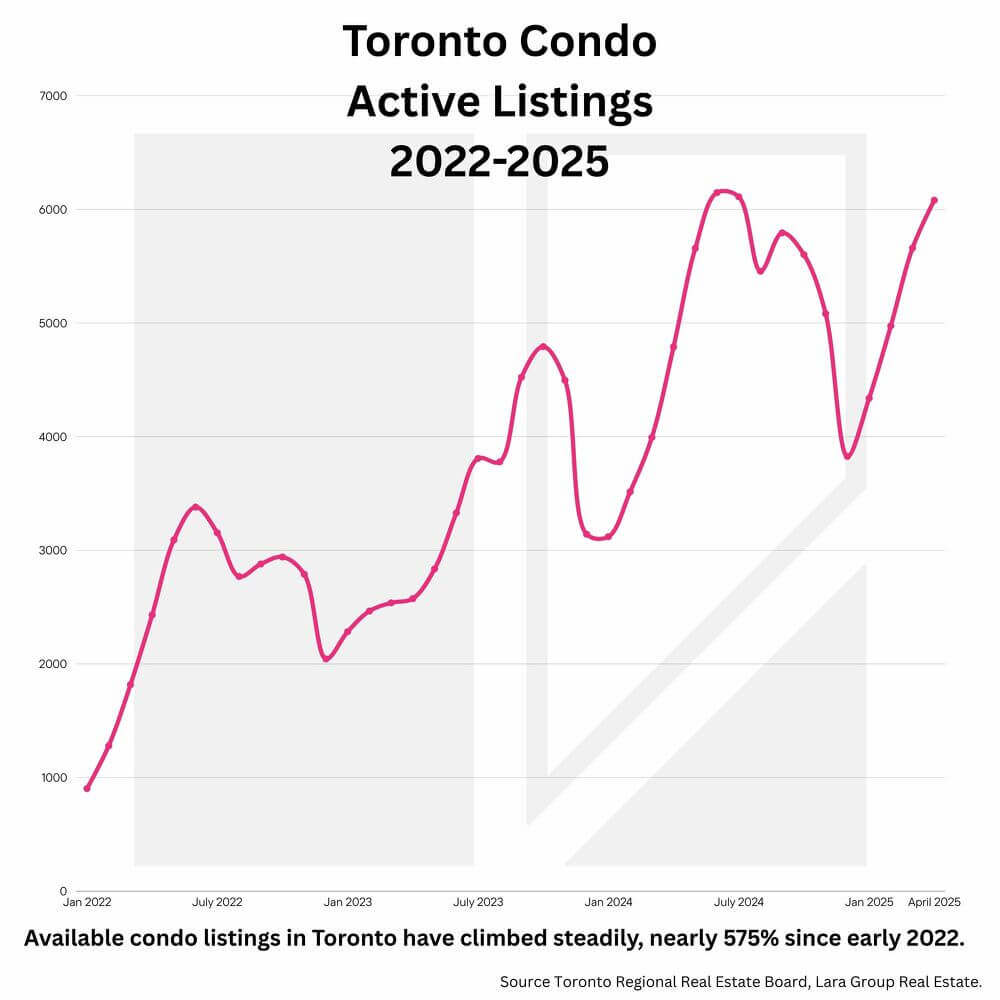

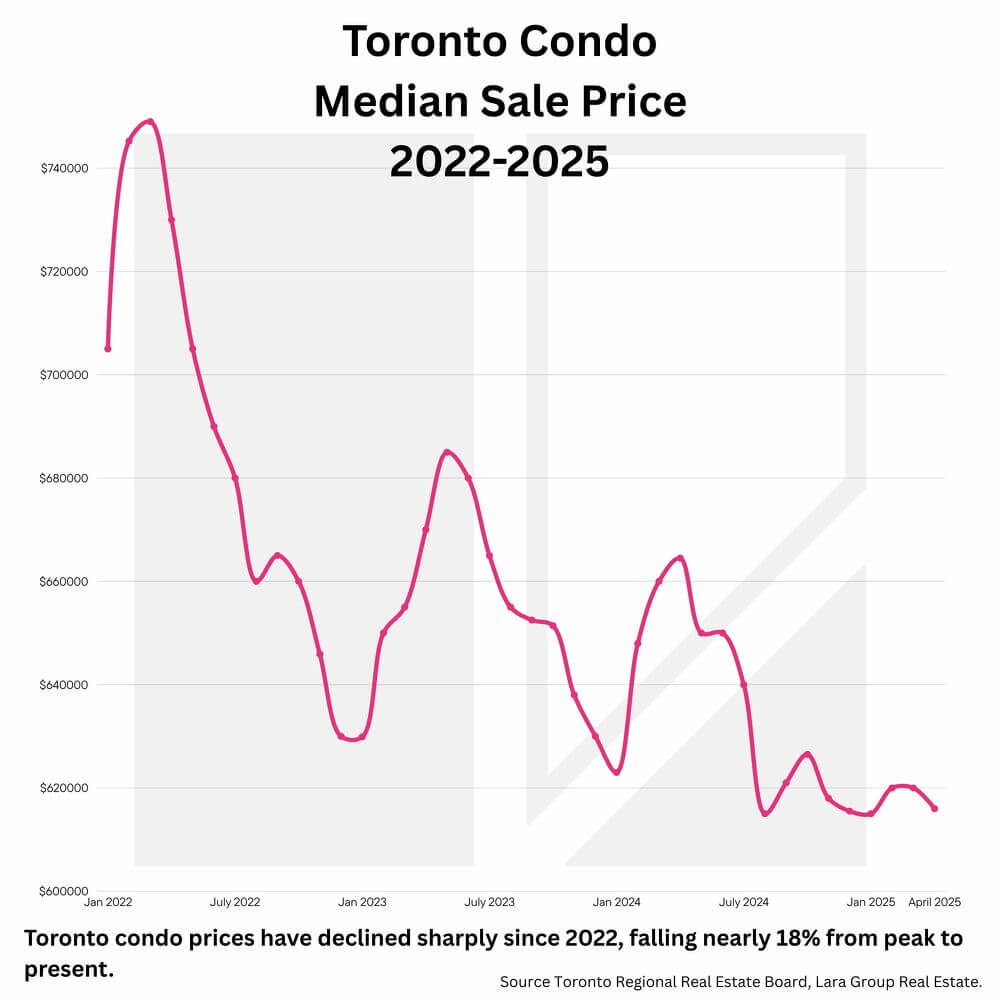

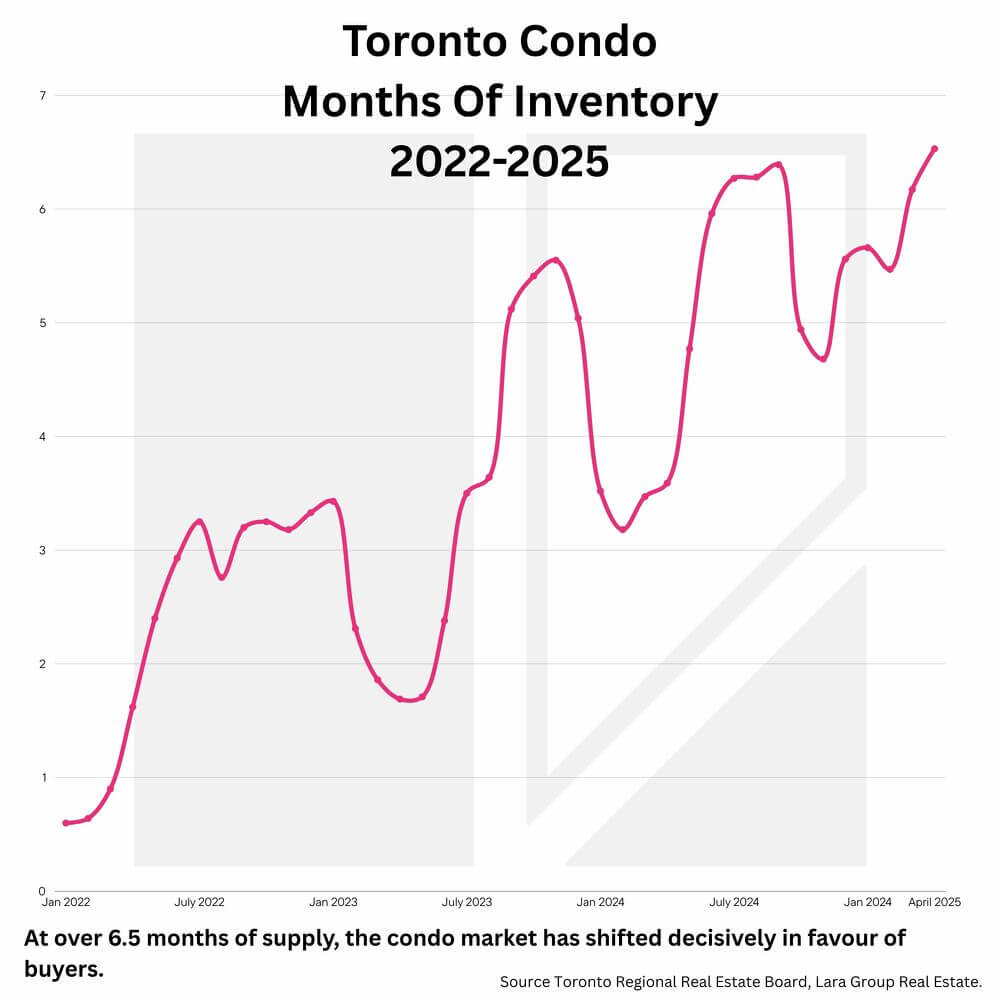

According to recent data from the Toronto Regional Real Estate Board, the average condo price in Toronto has declined by approximately 7.6% year-over-year, now hovering around $710,000. Inventory levels have surged by 28%, and months-of-inventory for condos has reached 6.5, solid indicators of a buyer’s market. Condo sales activity has dropped by approximately 30% year-over-year, and the 215 new condo sales in the City of Toronto in Q1 fell to their lowest level since 1990, according to a recent market report by Urbanation.

“This is the kind of market shift that clears out the noise,” said Andres Lara, co-founder of Lara Group Real Estate, a boutique team known for blending market insight with an artistic approach to storytelling and marketing. “When investors and speculators retreat, you get a market that becomes more transparent, more accessible, and ultimately more rational. That’s good news for end-users and serious buyers.”

Industry insiders agree that the recent cooling is not a bubble bursting, but rather a course correction following years of inflated expectations. For buyers who had been priced out or sidelined by aggressive bidding wars, this reset is being viewed as a strategic opening.

“The current conditions are giving regular buyers a fighting chance,” said Theresa Baird, broker at The TB Realty Group and an industry veteran with over 25 years of experience. “We’re seeing clients who had paused their searches last year due to affordability concerns now coming back to the table with renewed confidence.”

But while conditions favour buyers, both Lara and Baird warn that a strategic approach is required to navigate today’s market.

“We’re advising clients to look at older resale units from 2015 to 2020,” Baird added. “These properties often offer better square footage, layouts, and established communities, and they’re trading at a discount compared to newer builds that are still priced on yesterday’s assumptions.”

Preliminary insights from Lara Group’s client activity indicate a shift in buyer behaviour: a growing number of prospective buyers are requesting side-by-side comparisons of pre-construction vs. resale condos, with over 60% of active clients now prioritizing units with larger layouts and lower maintenance fees over brand-new status. This trend reflects a more analytical mindset, buyers are treating condo purchases less like speculative bets and more like value-driven lifestyle decisions.

“The truth is, a lot of these condos were never worth the price tag to begin with,” said Lara. “We’ve known for a while that some developers were banking on blind demand. Now that the fog is lifting, we’re finally having more honest conversations about value per square foot, functionality, and long-term livability.”

Recent figures from TRREB show that the number of unsold new condos has surpassed 23,000 units—the highest in over 30 years—while rental demand is beginning to soften, with average rents declining 3.8% year-over-year. Analysts say these trends reflect an affordability ceiling that both renters and buyers are hitting.

“It’s a bit of a reckoning,” said Baird. “The pre-construction condo market, in particular, has to adjust. Builders and developers need to rethink pricing, and more importantly, value. Sub-500 square foot units simply aren’t appealing, and at price points north of half a million dollars, they’re proving to be a less-than-desirable option for first-time buyers.”

Some agents are even reporting an uptick in conditional offers being walked away from due to financing difficulties or shifting buyer confidence—a sign that consumers are thinking more critically and less emotionally.

“There are more walk-aways than we’ve seen in recent years,” Baird said. “Buyers are no longer jumping at the first thing they see. They’re asking better questions, and that’s a healthy sign.”

Despite the challenges, both experts say this moment represents an inflection point—and possibly a generational opportunity.

“Markets like this don’t last forever,” said Lara. “We always look back and say, ‘I wish I had bought during that dip.’ Well, this might be that dip. The key is being informed and ready.”

For now, the message from the front lines of Toronto real estate is clear: the condo market may be down, but it’s far from out. The smart money isn’t running away – it’s paying attention.

Media Contact

Company Name: Lara Group Real Estate

Contact Person: Andres Lara

Email: Send Email

Phone: 416-820-3935

Country: Canada

Website: https://laragroup.ca