Invoice Process Automation from IBN Technologies Becomes a Strategic Priority for Nevada CFOs

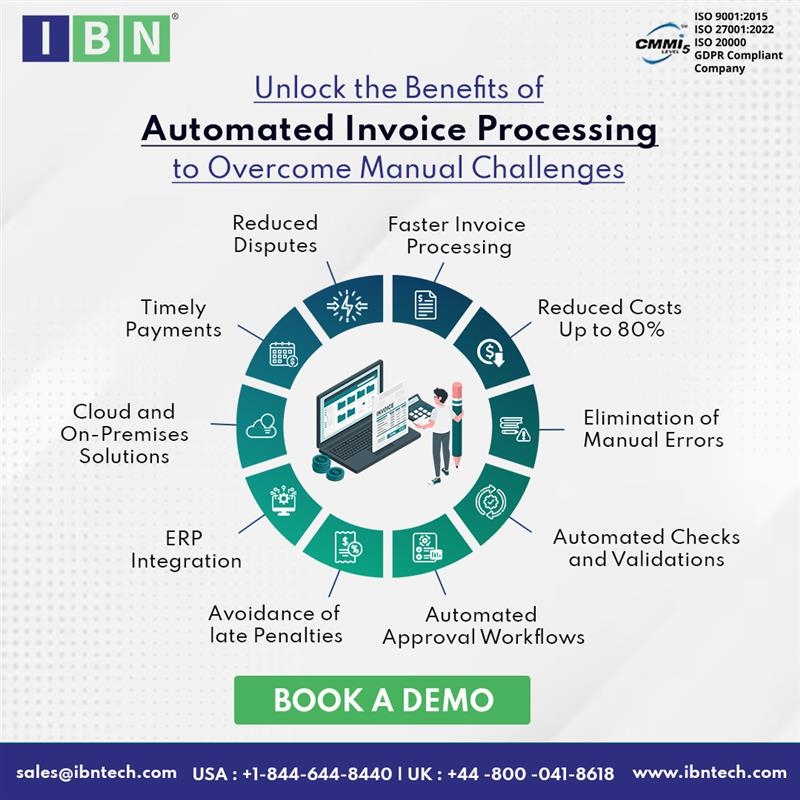

Miami, Florida – 26 June, 2025 – Finance departments are upgrading their operating models to match the pace of modern billing. Supplier invoicing continues to grow more frequently and diverse, placing added responsibility on accounts payable systems. Organizations are responding with strategic implementations, prioritizing invoice process automation as a way to increase accuracy, improve processing speed, and maintain financial clarity.

In Nevada, automation has begun driving a significant shift in operational routines. Companies are now aligning their payment cycles with digital tools that minimize delays and errors. The integration of Automated Invoice Management gives finance teams more reliable data, organized document handling, and faster approval cycles. These advancements allow for stronger alignment between vendor relationships, internal compliance standards, and cash flow planning. Automation sets a new benchmark across financial departments, helping decision-makers operate with clarity and confidence. By enhancing invoice controls and approval frameworks, businesses are creating a financial structure that supports growth and process transparency. This shift signals a larger trend toward digitized control and scalable infrastructure across the accounts payable landscape in Nevada’s evolving business climate. With automation now embedded into core workflows, financial operations are more stable, timely, and structured than ever—positioning finance leaders to meet operational goals with greater agility and consistency.

Lead your finance transformation journey with automation that scales!

Get a free consultation: https://www.ibntech.com/free-consultation-for-ipa/

Manual Invoicing Slows Operations

Several businesses still depend on manual systems for handling invoices, despite access to advanced financial tools. This reliance often introduces unnecessary time, labor intensity, and growing operational pressure. As invoice volumes increase, manual processing leads to inefficiencies that can disrupt payment cycles and slow financial decisions. Errors in entry, lost paperwork, and processing inconsistencies remain a challenge across many accounts payable departments.

-

Repetitive invoice entry limits team productivity and capacity

-

Misentries and duplications often create discrepancies in payment records

-

Approvals and disbursements lag due to manual routing

-

Tracking issues emerge from insufficient visibility into invoice stages

-

Inconsistent logs affect audit accuracy and documentation consistency

-

Department-level variation limits smooth, company-wide coordination

-

Growing supplier networks stress invoice handling capabilities

-

Lack of controls elevates exposure to payment-related fraud

Companies across Nevada are solving these problems by investing in automation. Firms including IBN Technologies have implemented invoice process automation to remove delays, prevent manual errors, and enhance invoice clarity. These solutions support faster financial workflows, promote transparency, and help businesses scale confidently in today’s fast-moving economic climate.

Smarter Tools Improve Invoice Accuracy

Adopting automation has become essential for finance departments aiming to eliminate processing delays and inaccuracies. With operational pressures mounting and invoice volume increasing, structured solutions are reshaping how invoice cycles function. IBN Technologies delivers a unified system that reduces errors, quickens approvals, and enables teams to work with precision.

• OCR tools extract invoice data clearly and reduce entry delays

• Error detection identifies duplicates and prevents overpayment mistakes

• Custom workflows ensure approvals match internal finance structures

• Teams monitor invoices through a single real-time interface

• Integrates smoothly with accounting and ERP platforms in use

• Discrepancy alerts help resolve issues without manual follow-up

• System-generated logs simplify compliance reporting and reviews

• Scales well to accommodate higher invoice traffic and vendors

• Reduces human effort while maintaining full transaction visibility

• Drives better decision-making through structured invoice process automation

With this invoice automation framework in place, businesses across Nevada are achieving greater control, stronger audit readiness, and improved workflow efficiency—making financial operations faster and more dependable.

Streamlined Outcomes Through Automation

A public sector finance department initiated an upgrade to eliminate invoice approval delays and enhance processing speed. Through invoice process automation, teams achieved faster, more consistent financial workflows.

● Over 90,000 invoices were processed yearly, cutting cycle time by 75%.

● Post-deployment saw better vendor alignment and strong compliance outcomes.

Solutions from companies like IBN Technologies integrated into existing ERP systems, delivering transparency and operational clarity across approval stages.

Elevating Finance Through Automation

High-volume invoice environments demand a level of efficiency that manual processes struggle to support. With invoice process automation, finance departments can now handle supplier documentation with speed, clarity, and structure. The shift to digital workflows minimizes delays, reduces human effort, and builds uniformity across payment cycles. Businesses adopting these solutions are better equipped to manage approval timelines while reducing dependence on error-prone methods.

Growth-minded companies are now prioritizing scalable platforms that offer long-term reliability and accurate reporting. With tools such as Accounts Payable Automation, many finance leaders are experiencing improvements in vendor coordination and clearer audit trails. These systems are enhancing operational agility and helping departments maintain better internal controls, supporting broader financial goals without adding complexity to the process.

Related Service:

AP and AR Automation Services: https://www.ibntech.com/ap-ar-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Media Contact

Company Name: IBN Technologies LLC

Contact Person: Pradip

Email: Send Email

Phone: +1 844-644-8440

Address:66, West Flagler Street Suite 900

City: Miami

State: Florida 33130

Country: United States

Website: https://www.ibntech.com/